State IRA Websites: A Valuable Tool for Public Education

For the Inflation Reduction Act to be successful, the public needs to know how to apply for, qualify for, and receive the many tax credits and rebates that will be offered. Between rebates from the Home Energy Rebate Programs and tax credits for consumers, businesses, and tax-exempt entities, consumers have the potential to save billions of dollars and significantly reduce climate pollution from homes, buildings, and vehicles. States, who are responsible for administering many of these programs, can play a valuable—indeed essential—role by informing their residents of these opportunities and showing the relationship between federal IRA incentives and state programs and incentives.

One of the simplest ways that states can advertise IRA incentives to their residents is through an easily accessible, consumer-facing, webpage. The needs of every state’s residents will be different, so states should respond to those particular needs in any consumer-facing IRA webpage that they produce. That said, there a few principles that all consumer education webpages would benefit from:

- Make webpages easy to find through search engines like Google. Search phrases like “IRA incentives New York,” or “Maine climate incentives ” should turn up the website.

- Keep webpages up to date. Guidance around IRA programs and incentives is evolving constantly. Keeping the webpage up to date with the latest information is crucial to helping consumers access incentives and programs. In cases where federal guidance is still pending, give users as much information as possible and let them know that the webpage will be updated when more information is available.

- Make webpages attractive and easy to use. Simple, colorful, and modern-looking webpages will help users engage with materials and information on the page, and it will help users trust that the information provided is up to date.

Below CESA describes three webpages and one PDF that are standout examples of good consumer outreach. They are easy to find on the web, contain comprehensive and up-to-date information about all consumer-eligible IRA programs, and look attractive and well-designed. Each presents information about IRA incentives in a distinct but effective manner, and other states and nonprofit organizations may find these examples helpful in designing their own consumer-facing IRA webpages.

We encourage readers to click on the corresponding links to explore the pages fully.

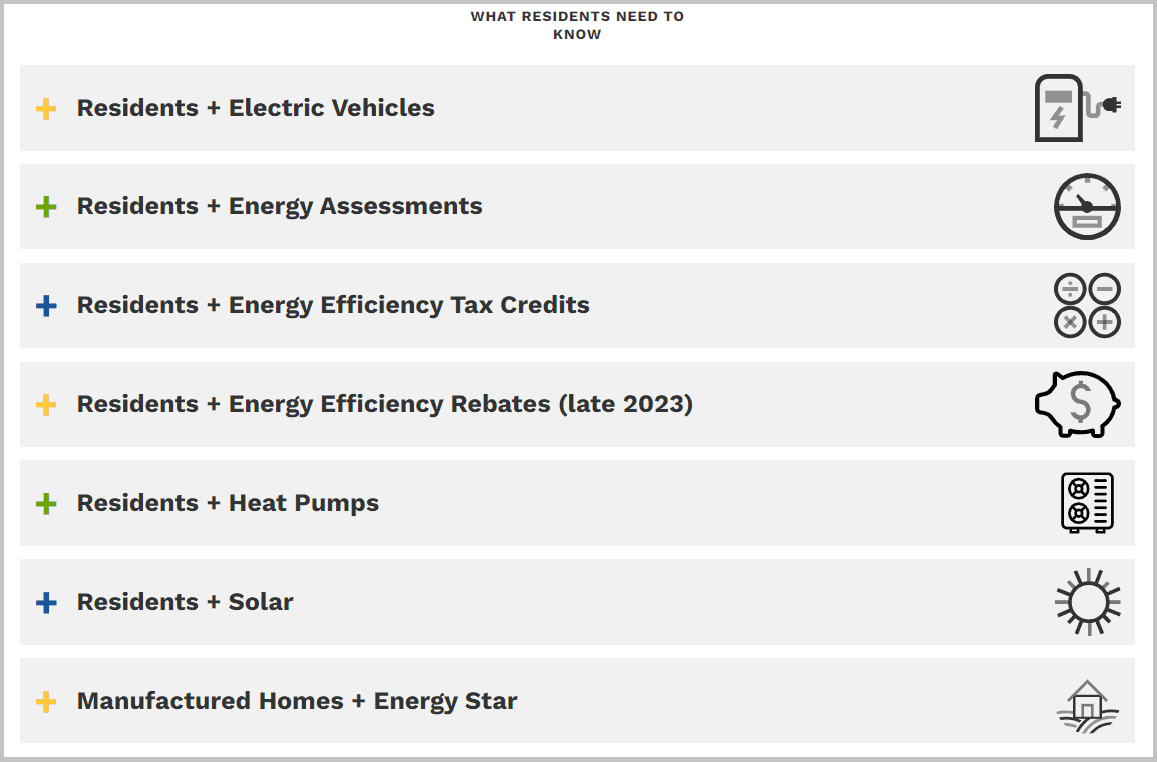

Minnesota Clean Energy Resource Teams (CERTs) – The Inflation Reduction Act: what you need to know

Clean Energy Resource Teams (CERTs) is a public-private partnership that catalyzes clean energy development in Minnesota and is partnered with the Minnesota Department of Commerce. The CERTs IRA webpage is attractive and inviting, and it divides information about IRA incentives into three categories based on recipients: Residents, Businesses, and Tax-Exempt Entities.

The webpage also features articles explaining tax credits vs. rebates, area median income, and direct pay. Lastly, the CERTs IRA page includes a helpful list of additional resources to understand IRA incentives and calculate savings, such as the Rewiring America Savings Calculator and CleanEnergy.gov.

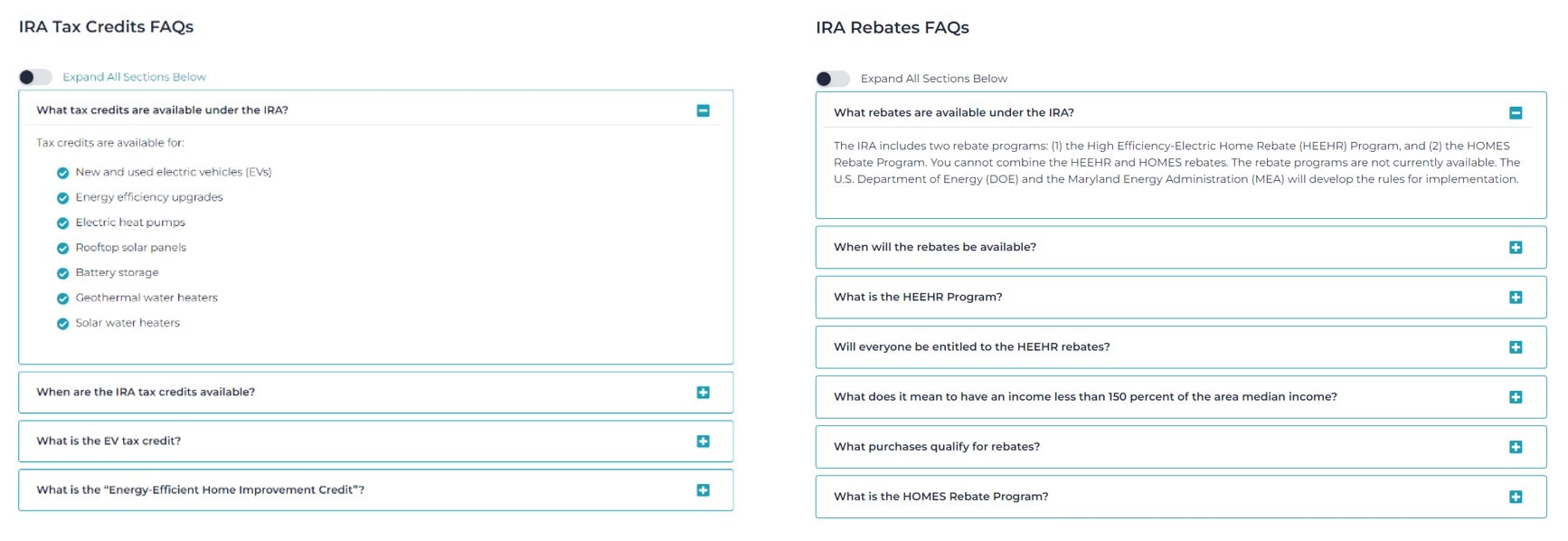

Maryland Office of the People’s Counsel – Inflation Reduction Act

The Maryland Office of the People’s Counsel (OPC) is the consumer advocate branch of the Maryland state government. OPC’s IRA webpage uses a similar design to CERTs, and they present information as frequently asked questions (FAQs ), divided into two sections aimed at consumers: Tax Credits and Rebates. FAQs can be an effective tool for helping consumers understand IRA incentives, because they let webpage users find information quickly, without having to read through lots of text. Above the FAQs, OPC includes an explanation of the difference between tax credits and rebates.

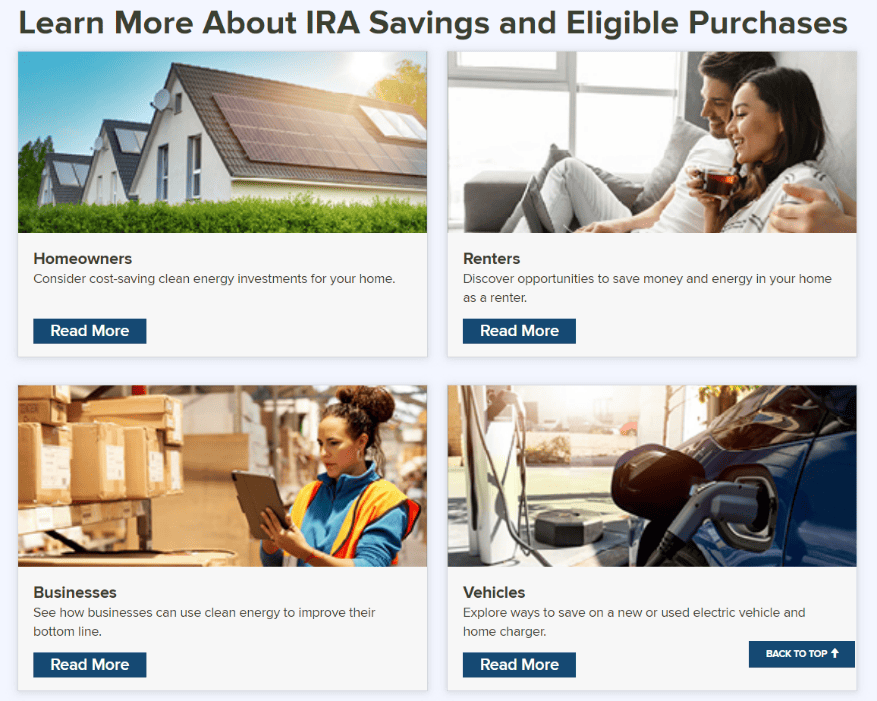

New York State Energy Research and Development Authority (NYSERDA) – NYS Guide to Inflation Reduction Act Savings

NYSERDA’s IRA savings guide takes yet another approach, providing a concise yet thorough explanation of IRA and dividing IRA incentives into four separate webpages for Homeowners, Renters, Businesses, and Vehicles.

Each page includes tables listing federal and state tax incentives and rebates for eligible products and improvements, as well as links to more information about different clean energy technologies, including electric vehicles and chargers, weatherization, solar, battery storage, heat pumps, and heat pump water heaters.

Maine Governor’s Energy Office – Maine Won’t Wait: Mainers’ Guide to Climate Incentives

The Mainer’s Guide to Climate Incentives is a PDF document, rather than a webpage. It can be difficult to make a PDF as interactive as a webpage, since they are mostly static, but they offer one particular advantage: they are easy to print out and share physically. The Mainers’ Guide divides IRA incentives into categories for Homes, Businesses, and Electric Vehicles. Each section includes an accompanying illustration showing the reader what each eligible technology looks like and how it might fit into their daily life. The Mainer’s Guide also includes a list of FAQs and a step-by-step guide for consumers to apply for and get their rebate or tax incentive.