How to Make the Most of the Investment Tax Credit: Applying for Bonus Credits

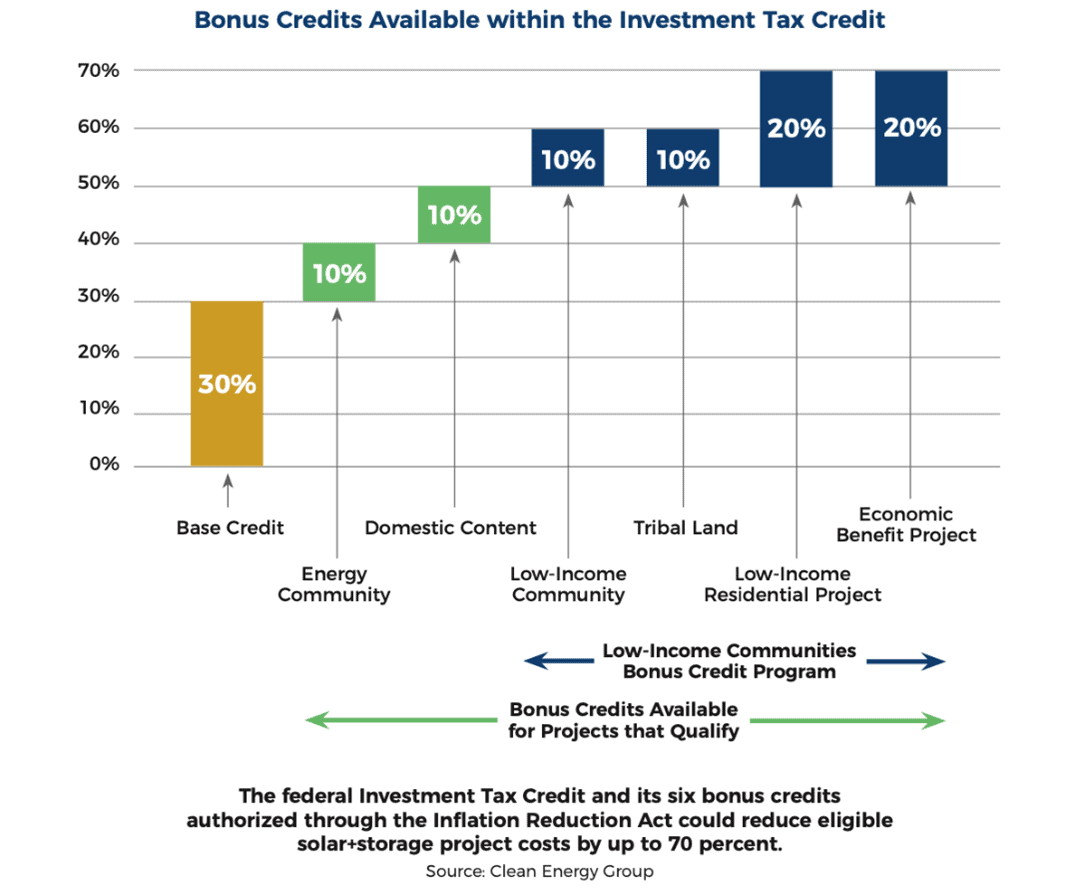

The Investment Tax Credit and its Bonus Credits are a game changer for improving the economics of solar and solar+storage projects. For most customer-sited projects, at least 30 percent of eligible solar and solar+storage project costs are eligible for either:

- Direct pay reimbursement (for tax exempt entities) or

- A tax credit (for entities with tax liability)

Some projects could be eligible to receive up to 70 percent of eligible project costs by stacking one or more bonus credits on top of the 30 percent baseline credit. To learn more about each of the bonus credits and potential project eligibility, view Clean Energy Group’s one-page fact sheets. To learn about the application process for the Bonus Credits including how and when projects should apply, read on.

This post focuses on only four of the bonus credits, which are included under the Low-Income Communities Bonus Credit Program. It does not refer to the energy community bonus credit nor the bonus credit for meeting domestic manufacturing requirements.

The information provided in this post was gathered primarily from the US Department of Energy’s (DOE) Low-Income Communities Bonus Credit Program webpage. DOE is coordinating the bonus credit application process. Please refer to DOE’s website for the most up-to-date and accurate information.

Application Process

The process to receive a Low-Income Communities Bonus Credit involves two steps: an application for an “allocation of capacity” and a “placed in service” submission.

The DOE Frequently Asked Questions page describes these two steps, quoted below:

Step 1: Applicants submit an application for an allocation of capacity for each individual facility by applying to the appropriate category and application option. Applications are reviewed by the DOE review team and then approved or rejected by the IRS. If approved, the applicant will receive an allocation approval notice and the facility must be placed in service within four years of the date the allocation approval notice was issued.

Step 2: After the facility has been placed in service, the applicant will return to the Applicant Portal to report the date the facility was placed in service, confirm there have been no material ownership and/or facility changes, and submit the required documentation. If approved, the applicant is notified that it may claim the energy percentage increase through the applicant’s applicable tax filing process.

Application Timeline

The Low-Income Community Bonus Credit program requires that interested parties apply for a capacity allocation for each eligible project. Each of the four bonus credits within this program have an annual Capacity Limitation, which is divided across the facility categories for program year 2023 as follows:

| Category 1: Located in a Low-Income Community (residential behind-the-meter facilities) | 490 megawatts |

| Category 1: Located in a Low-Income Community (other eligible behind-the-meter and front-of-the-meter facilities) | 210 megawatts |

| Category 2: Located on Tribal Land | 200 megawatts |

| Category 3: Qualified Low-Income Residential Building Project | 200 megawatts |

| Category 4: Qualified Low-Income Economic Benefit Project | 700 megawatts |

There will be an opportunity for projects to apply for an allocation each year. The 2023 program application process opened on October 19, 2023, and will be open for at least 30 days and until capacity for each of the four categories has been reached (it will potentially remain open through early 2024). The 2024 program application process will open in Quarter 2 of 2024. The application process in 2024 and beyond may change from what the process is in this cycle. This post will follow the 2023 program application process for capacity allocation.

Important 2023 Program Dates:

- October 19: 2023 program application process opens.

- November 18: 30-day application window closes at midnight EST. Applications submitted within the first 30 days will be treated as submitted on the same date and at the same time. Applications received after November 18 will be reviewed only if the capacity limitation has not been reached.

- November 19: Rolling application submissions continue until close of the program year. The 2023 program will close when capacity for each category has been reached. It could potentially remain open through early 2024.

Application Requirements

Parties interested in applying for a capacity allocation will need to compile and submit key project information, including:

- Facility Location (including latitude and longitude to 5 decimals)

- Facility Technology Type (Solar or Wind)

- Facility Nameplate Capacity (kilowatt AC [and/or kilowatt DC required for solar facilities])

- Customer/Offtaker Type

- Ownership Model

- Point of Interconnection (Behind-the-Meter [BTM], Front-of-Meter [FTM], or Off-Grid)

In addition to supplying this information, applicants are required to provide “adequate documentation and attestations” to demonstrate that the project is viable, well-defined, and likely to be placed in service within four years (the deadline to receive the bonus credit, if awarded). To fulfill this requirement, the applicant applying for the bonus credit must have a contract for the project in place. Per the Treasury Department and IRS rulemaking, all behind-the-meter projects need to submit “an executed contract to purchase the facility, an executed contract to lease the facility, or an executed power purchase agreement for the facility, in their entirety inclusive of any amendments, appendices, consumer disclosures, and schedules thereto.”

The final regulations clarify that “the rules do not have any date restrictions on the documentation required”. Thus, a project applying for the bonus credits can submit in its application a contract that was executed before the Investment Tax Credit was updated and expanded.

There are additional documentation and attestation requirements for projects applying to each of the four bonus credit categories and, separately, for BTM projects that are larger than one megawatt AC in size and FTM projects of any size. The IRS Revenue Procedure 2023-27 lists and defines the documentation (in Sections 7.04(2) and 7.04(3) on pages 5-7) and attestations (in Sections 7.05(2) and 7.05(3) on pages 7-9) that different types and sizes of projects need to supply.

How to Apply

All applicants registering for the Low-Income Communities Bonus Credit Program on behalf of their organization will first need a Login.gov account. To register and submit an application for an organization, the applicant must have the authority to act on behalf of and legally binding for the organization and will be responsible for signing attestations for the organization.

After creating a Login.gov account or using an existing account, the applicant may register their company through DOE’s Applicant Portal at https://eco.energy.gov/ejbonus. The time needed to complete and submit an application will vary. DOE estimates the average time for recordkeeping and reporting within the application process is one hour.

Clean Energy Group recommends reviewing DOE’s program webpage and list of resources including the 2023 program’s:

- Frequently Asked Questions

- Applicant Checklist

- Applicant User Guide

- Informational Webinar (recording from September 29, 2023)

Additional Selection Criteria

The Low-Income Communities Benefit Program in 2023 will reserve at least 50 percent of the total capacity in each program category to facilities meeting at least one of the two ‘Additional Selection Criteria’ (ASC), based on Ownership and Geography.

The Ownership criteria is based on characteristics of the applicant that owns the qualified solar, solar+storage or wind facility. Eligible entities include:

- Qualified tax-exempt entities, such as 501(c)(3) and 501(d) nonprofit organizations, municipal, state, and Tribal governments, and Washington D.C.

- Tribal enterprises

- Alaska Native Corporations

- Renewable energy cooperative

- Qualified renewable energy companies

The Geographic criteria is based on the county or census tract where the facility is located. To meet this criterion, a facility would need to be located in either:

- A Persistent Poverty County (PPC), generally defined as any county where 20 percent or more of residents have experienced high rates of poverty over the past 30 years.

- A census tract that is designated in the Climate and Economic Justice Screening Tool (CEJST) as disadvantaged. This includes tracts that are either 1) greater than or equal to the 90th percentile for energy burden and is greater than or equal to the 65th percentile for low income, or 2) greater than or equal to the 90th percentile for PM2.5 exposure and is greater than or equal to the 65th percentile for low income.

Projects can assess their eligibility for the geographic selection criteria by opening this online mapping tool produced by DOE and NREL. Under ‘Map Layers’, make sure that the two ASC options, “CEJST Energy” and “Persistent Poverty County,” are selected.

Per DOE, “Applications meeting both Ownership and Geographic criteria will be prioritized ahead of applications meeting only Ownership or Geography. Applications that do not purport to meet [either] additional selection criteria are ranked last and reviewed only if there is remaining capacity.” Applicants applying under ASC Ownership criteria will need to provide documentation demonstrating its eligibility.

Additional Resources

The Low-Income Communities Bonus Credit Program for 2023 reflects the final regulations the Internal Revenue Service (IRS) and Treasury published on August 15, 2023, available here. To find the full definition and requirements of each program category, refer to the IRS Revenue Procedure 2023-27, which is available here.

Clean Energy Group and Clean Energy States Alliance published several blog posts and resources about the updates to the Investment Tax Credit and the impact of the Inflation Reduction Act including:

- What Nonprofits Need to Know about the Investment Tax Credit

- Investment Tax Credit Fact Sheets: Bonus Credit Program

- Low-Income Communities Bonus Energy Investment Credit Program: Answers to Frequently Asked Questions

- The Inflation Reduction Act Offers Powerful Tools for Solving the Peaker Problem

- The Inflation Reduction Act is a Game Changer for Nonprofits Seeking Solar+Storage

Direct Pay for Tax Exempt Entities

Tax exempt entities and governmental entities are now able to access the Investment Tax Credit and its bonus credits through direct pay reimbursement, also referred to as elective pay. The IRS issued proposed regulations for the implementation of the direct pay option on June 21, 2023. The IRS is expected to release final regulations later this year.

To learn more about the direct pay option and the process to receive direct pay reimbursement, visit:

Published On

October 30, 2023