New Strides in the Residential PACE Space

While the costs of solar photovoltaics (PV) have decreased considerably over the last decade,[1] many customers still need long-term, low-cost financing to make going solar affordable. Financing mechanisms like leases, loans, and power purchase agreements spread out the initial cost of residential solar installations over a term of years.

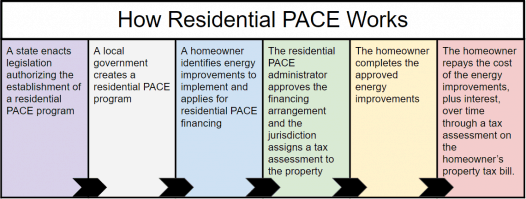

Residential Property Assessed Clean Energy (R-PACE) offers another solution for homeowners to pay for a solar investment over time. While the structure, capital source, and administration of programs vary, residential PACE enables a local government to fund energy improvements, such as solar, on a qualifying taxpayer’s home and to recoup the expense, with interest, through a tax assessment paid over time by the homeowner. The tax assessment, which remains in place for the life of the obligation, is levied through the homeowner’s property tax bill. Residential PACE payment obligations can transfer to subsequent property owners along with the benefits of the energy improvement. Because the obligation is secured by the underlying property, it can support repayment terms of twenty years or longer at attractive interest rates.

To enable residential PACE, state legislation must authorize the program. Residential PACE programs are in place in a handful of states, most notably California,[2] but program development has experienced regulatory challenges over the last several years. Government-sponsored entities Fannie Mae and Freddie Mac, which purchase, guarantee, and securitize home mortgages from banks and small lenders, have expressed concern that residential PACE poses a threat to the secondary mortgage market because PACE assessments may create senior liens superior to existing mortgages.[3] In 2010, the Federal Housing and Finance Agency (FHFA), the agency which serves as conservator of Fannie Mae and Freddie Mac, directed Fannie Mae and Freddie Mac to cease purchasing the mortgages of PACE-encumbered properties.[4]

In July 2016, the Federal Housing Administration (FHA), an entity separate and distinct from the FHFA, released new guidance clarifying the conditions under which homes with PACE assessments can be purchased or refinanced with mortgage products provided by the FHA. Although FHA-insured loans make up a relatively small proportion of the lending market for housing in the U.S., the new guidance lends greater legitimacy to residential PACE by explicitly authorizing FHA-insured mortgages on qualifying properties with PACE assessments.[5]

While the FHFA has not changed its position in light of the FHA’s PACE guidance, the U.S. Department of Energy has announced that it will offer technical assistance “to support the design and implementation of effective PACE programs” and released an updated draft of its Best Practice Guidelines for Residential PACE Financing Programs. Interested policymakers and officials should stay tuned for additional residential PACE market developments.

***

[1] Galen Barbose and Naïm Darghouth, “Tracking the Sun IX,” Lawrence Berkeley National Laboratory, August 2016, https://emp.lbl.gov/sites/all/files/tracking_the_sun_ix_report.pdf

[2] A list of residential PACE programs compiled by PACENation is available at http://www.pacenation.us/residential-pace/.

[3] Jeremy Brown, “PACE in Texas: The Future of Contractual Assessment Financing for Conservation Improvements,” Center for Global Energy, International Arbitration, and Environmental Law, April 2013, https://www.utexas.edu/law/centers/energy/wp/wp-content/uploads/centers/energy/property_assessed_clean_energy_texas.pdf

[4] Corinne Russell and Stefanie Johnson, “FHFA Statement on Certain Energy Retrofit Loan Programs,” Federal Housing Finance Agency, July 6, 2010, http://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Statement-on-Certain-Energy-Retrofit-Loan-Programs.aspx.

[5] John J. Marciano III, Gregory W. Lavigne Jr. & Daniel Phillip Sinaiko, “Can New Federal Guidance Unlock the Residential PACE Market? We’re Almost There!,” Tax Equity Telegraph, July 2016, http://www.mondaq.com/unitedstates/x/512872/Renewables/Can+New+Federal+Guidance+Unlock+The+Residential+PACE+Market+Were+Almost+There

This article was originally published on NREL’s Solar Technical Assistance Team (STAT) Blog. Read the original post here.

This article was also posted on Renewable Energy World.

Published On

September 7, 2016