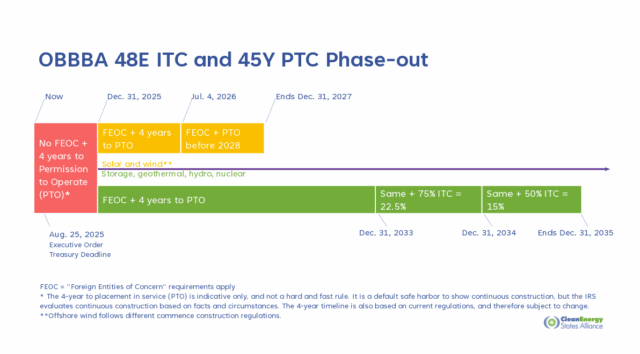

OBBBA Tax Credits Summary Diagram

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, significantly changes clean energy tax credits available under the Inflation Reduction Act (IRA) of 2022. This includes the Clean Electricity Investment Credit (48E ITC) and the Clean Electricity Production Tax Credit (45Y PTC). For wind and solar facilities, these tax credits will be eliminated for projects placed into service after December 31, 2027, unless construction begins by July 4, 2026. A July 7 executive order instructed Treasury to act to “strictly enforce the termination of” the ITC and the PTC, including issuing new regulation to modify the current process applicable to commencing construction and to implement new Foreign Entities of Concern (FEOC) rules. Treasury issued a notice with new rules on commence construction on August 15, 2025.

As the applicable rules can be confusing, CESA has published a diagram displaying primary dates for commencing construction, FEOC, and placement in service by technology in one print out diagram to use as a quick reference.

Associated Project(s):

Resource Details:

Date: September 19, 2025

Type:

Topic(s): Energy Storage, Land-Based Wind, Low- and Moderate-Income Clean Energy, Offshore Wind, Solar PV