Resource Archive - 2015

SEARCH RESOURCES

You can also search by author name.

RESOURCE TYPES

RESOURCE TOPICS

RESOURCE PROJECTS

RESOURCE YEARS

This slideshow provides information firefighters need to know to deal with fires on buildings equipped with PV systems.

This guide is designed for use by condominium owners in the Commonwealth of Massachusetts. It can help a “solar champion,” an interested member of a condominium association, to explore the options for installing solar PV.

This guide is designed to help homeowners make informed decisions about financing solar. It is a state-specific version of CESA’s 2015 report, “A Homeowner’s Guide to Solar Financing: Leases, Loans and PPAs.”

The report concludes that with the right market structures and incentives, solar+storage systems can provide a positive economic return on par with energy efficiency or stand-alone solar.

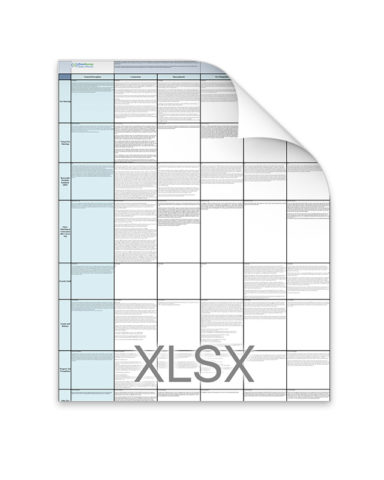

This Excel spreadsheet was produced by Clean Energy States Alliance (CESA) for the New England Solar Cost-Reduction Partnership through a grant from the U.S. Department of Energy SunShot Initiative’s Rooftop Solar Challenge II. The spreadsheet lists operative solar policies and programs for the five New England state participating in the New England Solar Cost-Reduction Partnership. The state policies and programs were collected and current as of September 2015.

This guide is designed to help homeowners make informed decisions about financing solar. It is a state-specific version of CESA’s 2015 report, “A Homeowner’s Guide to Solar Financing: Leases, Loans and PPAs.”

This report summarizes RPS compliance and reporting practices across the US and identifies best practices.

This report provides the first-ever comprehensive look at the ways in which states are advancing clean energy and suggests how to further encourage growth.

This case study analyzes data from the California Energy Commission’s New Solar Homes Partnership Program, part of California’s comprehensive statewide solar program, the California Solar Initiative.

Private Letter Ruling on the Eligibility of an Individual Panel Owner in an Offsite, Net-Metered Community-Shared Solar Project to Claim the Section 25D Tax Credit

The Internal Revenue Service has issued a Private Letter Ruling concluding that a particular owner of PV panels in an offsite, community-shared solar array is eligible for the residential tax credit under section 25D of the U.S. tax code.