Resource Archive - IRA & BIL Implementation

SEARCH RESOURCES

You can also search by author name.

RESOURCE TYPES

RESOURCE TOPICS

RESOURCE PROJECTS

RESOURCE YEARS

This document, part of CESA’s IRA Explainers and Guides Series for States, answers questions about the Build America, Buy America (BABA) Act and the domestic content bonus tax credit program requirements for awardees of the Greenhouse Gas Reduction Fund Solar for All program. It will be useful to other stakeholders as well to understand how BABA will apply to Solar for All and the differences between BABA and the tax credit requirements.

This deck is a short series of recommendations to Community-Based Organizations (CBOs) that wish to better understand the Greenhouse Gas Reduction Fund Solar for All competition and how to engage with the Solar for All opportunities. It briefly introduces the Solar for All competition, offers a realistic timeline for programs and funding deployment, and suggests concrete steps and resources for CBOs to support states in ensuring the success of the program.

This document is a comprehensive list of the functions needed to design and deploy a low- and moderate-income solar program as part of the Greenhouse Gas Reduction Fund Solar for All competition. This list can help states clarify which functions are needed and which are not for each program/sector, evaluate which functions to keep in-house vs. procure externally, and negotiate with EPA with a clearer understanding of next steps.

This report summarizes trends and calculates the potential impact of the EPA’s $7 billion Solar for All competition. The report provides the first public look into the range of state proposals that have been submitted in response to this competition. It can serve as a market readiness tool, to help states prepare for a massive and historic influx of LMI solar funding.

This explainer introduces states deploying federal funding to rules regarding worker protection, local wages, and benefits under the Davis Bacon Act. The plain English question-and-answer document was specifically prepared for states that will implement Greenhouse Gas Reduction Fund Solar for All programs, but it will be useful to other state agencies deploying Inflation Reduction Act funding.

Slides from a presentation by DOE for state energy agencies on writing an effective Community Benefit Plan, a required application component of all Inflation Reduction Act and Bipartisan Infrastructure Law funding opportunity announcements and loan applications.

This guide explains what information states should provide consumers on a state Home Energy Rebates webpage and highlights existing information by DOE, states, and other entities that provide models and useful resource information.

Manufactured homes, formerly referred to as mobile homes, comprise over 6 percent of America’s housing stock and represent an even larger share of housing for low- and moderate-income households. CESA has published an update to the “Solar for Manufactured Homes” report discussing potential funding opportunities through the Inflation Reduction Act.

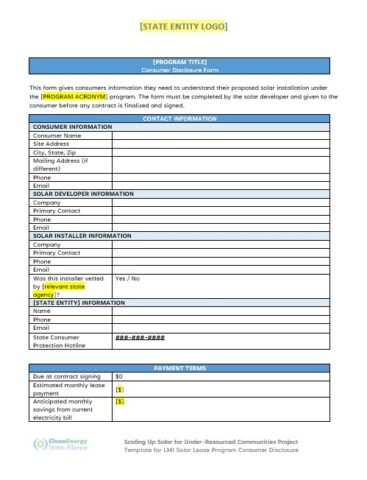

This Low- and Moderate-Income (LMI) solar lease template consumer disclosure form offers an example that states and other stakeholders can use to ensure that LMI customers participating in state programs designed to broaden solar access receive the information they need to understand their solar contracts. This template is meant to be used as a starting point for states building solar lease (or PPA) programs.

This guide offers simple options for states to add Multifamily Affordable Housing (MFAH) solar and/or solar+storage to their application to the $7 billion Greenhouse Gas Reduction Fund (GGRF) Solar for All competition (Solar for All) and take advantage of the new tax credit features of the Inflation reduction Act.