Resource Archive - Solar PV

SEARCH RESOURCES

You can also search by author name.

RESOURCE TYPES

RESOURCE TOPICS

RESOURCE PROJECTS

RESOURCE YEARS

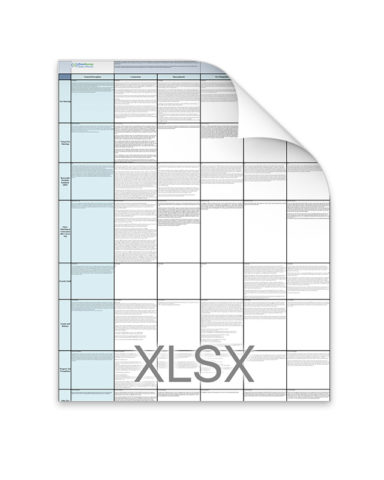

This Excel spreadsheet was produced by Clean Energy States Alliance (CESA) for the New England Solar Cost-Reduction Partnership through a grant from the U.S. Department of Energy SunShot Initiative’s Rooftop Solar Challenge II. The spreadsheet lists operative solar policies and programs for the five New England state participating in the New England Solar Cost-Reduction Partnership. The state policies and programs were collected and current as of September 2015.

This guide is designed to help homeowners make informed decisions about financing solar. It is a state-specific version of CESA’s 2015 report, “A Homeowner’s Guide to Solar Financing: Leases, Loans and PPAs.”

This report provides the first-ever comprehensive look at the ways in which states are advancing clean energy and suggests how to further encourage growth.

This case study analyzes data from the California Energy Commission’s New Solar Homes Partnership Program, part of California’s comprehensive statewide solar program, the California Solar Initiative.

The Connecticut Green Bank commissioned the Clean Energy States Alliance to prepare a report on the legal framework, need for, and viability of establishing a Residential Property-Assessed Clean Energy (R-PACE) program in Connecticut.

This report presents case studies of the eight recipients of the 2014 State Leadership in Clean Energy Awards.

This is a list of reports and studies by the National Renewable Energy Laboratory (NREL) that may be of interest to CESA members.

The Solarize Guide features detailed cases studies of two particularly well-developed and successful Solarize programs from New England—Solarize Connecticut and Solarize Mass—to help program managers in states across the country develop Solarize programs.

This report provides background on the New England Solar Cost-Reduction Partnership, some of the lessons and best-practices that have been gleaned from the project to date, areas where participating states are focusing on their soft-cost reduction efforts moving forward, and steps stakeholders can take to help advance the Partnership’s goals.

Private Letter Ruling on the Eligibility of an Individual Panel Owner in an Offsite, Net-Metered Community-Shared Solar Project to Claim the Section 25D Tax Credit

The Internal Revenue Service has issued a Private Letter Ruling concluding that a particular owner of PV panels in an offsite, community-shared solar array is eligible for the residential tax credit under section 25D of the U.S. tax code.