CESA Blog

Illinois becomes 13th state with energy storage procurement goal

With the signature today of Governor JB Pritzker, Illinois becomes the 13th state to adopt an energy storage procurement goal. The Clean and Reliable Grid Affordability Act directs the Illinois Power Agency to procure 3 gigawatts of energy storage by 2030, among other energy-related provisions. Analysis shows that this energy storage mandate could save Illinois…

Load growth: The impending grid apocalypse that’s giving your utility operator nightmares

What does the phrase “load growth” suggest to you? If you’re not working for an electric utility or regulatory agency, the answer is probably not much. But within the arcane world of distribution and transmission grid operators, state utility regulators and regional wholesale electric market arbiters, “load growth” evokes the kind of visceral chill normal…

States Convene in Washington to Discuss Navigating Energy Trends and Federal Programs

On May 28 and 29, 2025, the 2025 National Energy Summit for States took place in Washington, D.C., organized by the Clean Energy States Alliance (CESA) in conjunction with the National Association of Regulatory Utility Commissioners (NARUC) and other organizations. The Summit brought together state and federal energy officials, nonprofit leaders, researchers, and industry experts…

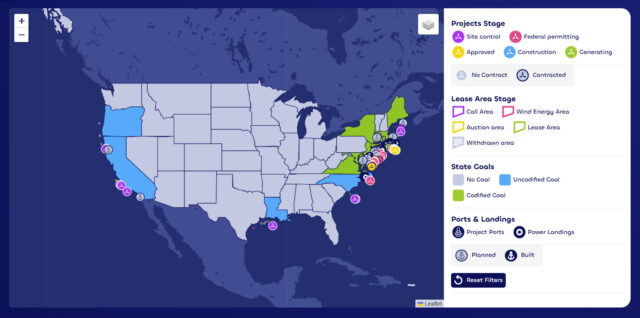

New Updates: CESA’s Offshore Wind Power Hub

The Clean Energy States Alliance is proud to present the newly updated Offshore Wind Power Hub, a comprehensive tool that tracks offshore wind developments in the United States to help state policymakers and advocates understand the status of offshore wind projects and make meaningful progress on offshore wind goals. The Offshore Wind Power Hub Interactive…

Reducing Peak Demand: Lessons from State Energy Storage Programs

States are increasingly adopting clean energy plans and climate goals, meaning our electric grids are more frequently fueled by variable renewables like solar PV and wind energy. While renewables are inexpensive and clean, they are not dispatchable without energy storage – in other words, they may not generate power at the right times to meet…

Can Table Salt Save the Energy Storage Industry? Experts Consider Sodium-Ion Batteries a Viable Alternative to Lithium-Ion

The most prevalent type of battery on the market today is lithium-ion. These batteries are used in cell phones, laptops, electric vehicles, and in both residential and grid-scale energy storage installations. Projections show that by 2029, demand for lithium-ion batteries will outpace the global supply of lithium. A recent webinar hosted by the Energy Storage…

CESA Offshore Wind Accelerator Year in Review – 2024

As the year comes to a close, CESA would like to thank all of our partners involved in our Offshore Wind Accelerator. CESA’s offshore wind projects are truly collaborative endeavors, and we are grateful to the talented staff in state and national governments, our colleagues at community-based environmental justice organizations and nonprofit organizations, and our…

Playing The Long Game: Why States Are Turning Their Attention to Long-Duration Energy Storage

After a decade of lithium-ion procurement, the leading clean energy states are finally turning their attention to long duration energy storage. Although it may still seem like a new idea, state-mandated procurement of energy storage has actually been going on for more than a decade. As of mid-2024, twelve U.S. states have set intentions to…

Three Questions with Kristin Urbach, Executive Director of the Connecticut Offshore Wind Collaborative

At the beginning of this year, the State of Connecticut launched the Connecticut Wind Collaborative (CWC), a nonprofit organization dedicated to advancing the offshore wind industry in the state. The CWC was conceptualized in Connecticut’s Offshore Wind Strategic Roadmap, published last October. CESA’s Sam Schacht spoke to CWC Executive Director, Kristin Urbach, about how she sees the new organization…

Three Questions with Kathryn Wright, Senior Program Officer for Clean Energy at the Barr Foundation, and Jay Campbell, Partner at Hart Research

In the fall of 2023, Connecticut, Massachusetts, and Rhode Island signed a Memorandum of Understanding to collaborate on offshore wind procurement. The MOU allows project developers to submit bids to multiple states at once, which could attract larger projects and drive down energy costs. This past July, the Barr Foundation and Hart Research published Views…

Four Leading State Clean Energy Programs win National Award

The Clean Energy States Alliance is pleased to announce the recipients of the 2024 State Leadership in Clean Energy Awards. Since 2009, the biennial Leadership Awards have recognized outstanding state programs and projects that have accelerated the adoption of clean energy technologies. The four winners were chosen by an independent panel of distinguished judges and…

Browse by Project

- IRA & BIL Implementation

- 100% Clean Energy Collaborative

- Building Decarbonization and Clean Heating/Cooling

- Energy Storage Policy for States

- Energy Storage Technology Advancement Partnership

- Interstate Turbine Advisory Council

- Low- and Moderate-Income Clean Energy

- New England Solar Cost-Reduction Partnership

- Offshore Wind

- Renewable Portfolio Standards

- Scaling-Up Solar for Under-Resourced Communities

- Solar with Justice: Connecting States and Communities

- State Energy Strategies Project

- State Leadership in Clean Energy

- Sustainable Solar Education Project